529

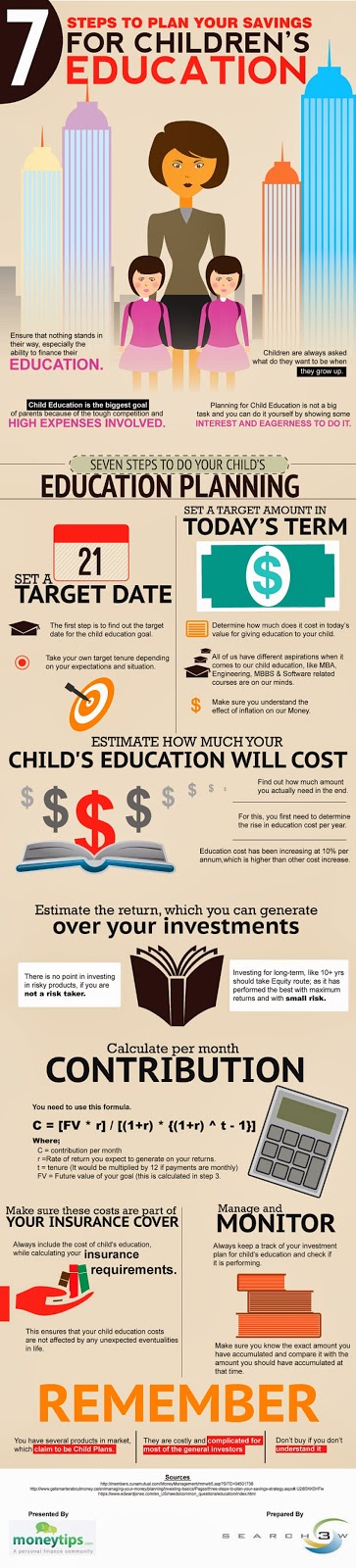

College Savings Plans were created by the Congress in 1996 to help

parents save for their children’s college fund. These saving plans

are also known as ‘Qualified Tuition Program’ and give tax

benefits on the principal amount. So, if you are a parent of a

new-born, then saving in these plans can reap you maximum benefits.

There are two types of 529 College Savings Plans:

- Pre-paid Tuition Choice: In this option, one can pay a child’s tuition fees at the current rate for the eligible state colleges or universities. The plan is also applicable if he or she decides to attend a college outside the state. Private colleges are also covered under this plan that allows parents to buy a tuition unit for a year.

- 529 Savings Option: This plan allows parents to save money towards their children’s tuition fees. Funds from the account can be used to pay towards a child’s tuition fees, school fees, books, room rent and various other expenses towards higher-education expenses. Every state has their own specific rules and regulations with the underlying same law governing all of them.

So,

save towards your child’s educational fund, so that when he or she

grows up you are able to secure their future by providing them higher education.

.jpg)